New Beauty: Market Disruption, But Not Interruption

Health and wellness will continue to be top priorities for consumers even after the coronavirus pandemic.

The beauty industry is constantly evolving, responding to consumer demands of the day and age. Health/wellness, hygiene, and feeling/looking more youthful have been consistent priorities over time. The global coronavirus pandemic, however, has amplified many of these and other concerns, creating opportunities for proven products to meet shifting market needs.

In total, according to estimates from SPINS in February 2020, beauty accounts for $41.6 billion annually in the U.S. Hair care is the largest segment with dollar sales reaching $10.3 billion and sales growth of 1.1%. Skin care and personal cleansing were also growing, but other segments, including cosmetics, were experiencing declines.

Natural/clean formulations, science-driven solutions with demonstrated efficacy, sustainability, transparency, and convenience have been top drivers for today’s market, according to experts.

While beauty/personal care (particularly premium and luxury products) seems to be among the top industries negatively impacted by the economic downturn, according to Euromonitor International data from May 2020, consumer health generally appears resilient. More than 30% of respondents to an April 2020 Euromonitor survey said they believe consumers will be buying more health and wellness-related products permanently as a result of the coronavirus pandemic.

Interestingly, 65% of global consumers consider mental well-being as a key factor in perceptions of health, and 34% take measures to manage stress, anxiety, and mental health, according to Euromonitor.

Meanwhile, the dietary/nutritional supplement market in the U.S. is worth about $36 billion, according to IRI sales data from 2019, and is expected to grow at healthy 10% CAGR over the next five years. With demand continuing to surge for preventive/wellness solutions, particularly immune health and sleep/stress products and ingredients, opportunities persist despite obvious challenges.

Reshaping the Market

Household penetration for natural and functional topical products, as well as beauty from within formulations, has been increasing, according to Maryellen Molyneaux, managing partner, Natural Marketing Institute (NMI).

“The desire for clean products/ingredients continues to grow with consumers who want less chemicals in their products due to increased concerns about those chemicals,” said Molyneaux. “In addition, many brands both niche and mainstream have put new efforts into formulations as well as marketing communications. We’ve also seen more new brand initiatives from larger mainstream companies such as Ulta’s new clean product certifications. These types of programs are educating mainstream consumers and growing the categories.”

According to analysis from market research firm Mintel, COVID-19 is impacting the way consumers approach beauty and personal care products, especially when they consider ingredient safety, cleanliness and shelf life.

“As the majority of Americans limit their interactions outside the home due to the COVID-19 pandemic, facial skin care routines become less of a priority, as consumers shift focus to their physical and mental health,” noted Clare Hennigan, senior beauty analyst at Mintel. “In addition, economic instability leads to more conservative category spending. As a result, the market is expected to see slower than expected growth in 2020. Once safety measures are lifted, typical skin care routines will likely fall back into place, leading to market recovery. A renewed focus on health and hygiene drives NPD (new product development), increasing demand for clean formulas, and creating opportunities for touchless formats.”

In a blog post in March 2020, Hennigan also discussed how the pandemic and economic downturn may affect the natural/clean beauty market. While the concept of “clean beauty” began with focus on “natural” formulations, the movement has evolved to consider “safety, transparency, sourcing/manufacturing practices and a slew of other factors that play into the final product,” she noted.

“The natural movement continues to shape the beauty industry as women become more conscientious of the ingredients in beauty products and seek out what is considered safe,” Hennigan said. “However, efficacy is also top-of-mind, with more than one-third of women agreeing that they care more about the effectiveness of a product than the ingredients it uses. While women expect brands to use natural ingredients, they ultimately choose a product based on efficacy, making it increasingly important for brands to link ingredient safety with function.”

Market Forces

An increasing number of individuals in their 20s and 30s are interested in starting skin care routines early to prevent signs of aging later in life, noted Sébastien Bornet, vice president of global sales & marketing at Horphag Research, which supplies Pycnogenol French maritime pine bark extract. “One-in-five young women are concerned about skin health and wrinkles before hitting their mid-20s, and one-in-three women under the age of 35 regularly use products to prevent signs of aging.”

The beauty-from-within movement has gained significant traction as people search for holistic health solutions, said Tim Hammond, vice president of sales and marketing, Bergstrom Nutrition. “Consumers now understand how powerful skin support can be when addressing and improving the underlying aspects of skin health.”

The beauty supplement market is driven by recognition that true “beauty” reflects a healthy body and good lifestyle practices. “It is also a celebration of one’s unique features; beauty is health, and health is beauty, no matter what age or gender,” said Sam Michini, vice president of marketing and strategy, Deerland Probiotics & Enzymes.

“Men are also making up more of the beauty care market, including supplements, and the gender-neutral beauty market is ramping up. According to NPD Group’s iGen Beauty Consumer report, nearly 40% of young adults aged 18 to 22 have shown interest in and support of gender-neutral beauty.”

Bornet noted better understanding of the role nutrition plays for skin health and the idea of healthy skin from the inside-out. “Consumers are simplifying their routines and embracing a minimalist lifestyle, which includes seeking skin care products that provide multi-tasking benefits to address their skin concerns rather than purchasing multiple creams and products.”

Consumers are also spending more time researching products and ingredients to inform their purchase decisions, he said. “They are most interested in natural ingredients backed by science to support their skin health without the potential irritation or side effects of other products.”

Katie Ferren, vice president, sales and marketing, Blue California noted increasing interest in ingestible beauty/wellness products, citing data from Euromonitor International, which indicated the beauty supplement market now accounts for over $80 million in sales in the U.S. alone.

Mainstream retailers have embraced the category, said Ferren, and at the same time it is also supported by online specialty brands. “From a consumer demographic perspective, Baby Boomers and now Gen Xers are looking for products that support beauty from within, and they are a large portion of the population with higher disposable income levels.”

Meeting Expectations

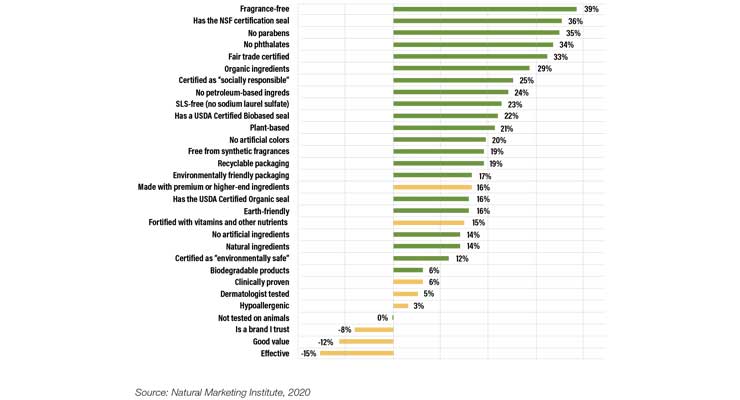

In terms of what consumers expect from products and brands, while “conventional” attributes such as “effective” and “good value” are highly important to personal care product purchases, according to Molyneaux, growth is strongest across sustainable attributes, and they have shown the most growth over the past 5 years (Figure 1). “Effective and good-value are declining, indicating consumers are more interested in clean products,” Molyneaux noted.

Figure 1. Percent Growth in Attributes Consumers Indicate are Very Important Toward Their Personal Care Product Purchase (2015 – 2019) (Orange shading denotes conventional attributes; Green shading denotes environmental/sustainable attributes)

According to a May 2020 report from Mintel titled “Facial Skincare and Anti-Aging: Incl Impact of COVID-19,” many consumers believe mental health reflects overall health and this can manifest into skin issues. “Since Eastern medicine is known to treat the body as an ecosystem, consumers are turning to these practices to balance the skin, mind and body,” the report said. “In fact, 68% of adults express interest in facial massaging techniques, such as facial yoga and lymphatic drainage. This holistic approach to skin care could mean consumers turn away from topical products to treat issues and rely on ingestible products to address the ‘source’ of the problem.”

A Mintel survey from March 2020 also indicated about 55% of adults agreed that diet is just as important as skin care products to impact skin appearance (Figure 2). “This push toward a holistic lifestyle has key implications on the beauty industry as self-care becomes an essential component of physical, mental and emotional health.”

Figure 2. Attitudes Toward Skincare Routine, March 2020

At the same time, environmentally conscious consumers are looking for brands that are committed to sustainability, and are taking action to reduce their carbon footprint.

About 24% of adults aged 18-34 are concerned about the environmental impact of their skin care products, according to Mintel. “To alleviate environmental concerns, consumers are demanding transparency from brands in regards to production methods and ingredient souring practices.”

Additionally, 34% of 18-24 year old beauty and personal care shoppers look for brands that have sustainability strategies. “To stand out in this crowded space, brands can appeal to young adults by offering eco-friendly claims and sustainably formulated and packaged NPD.”

Despite the pandemic and economic downturn, skin care appears to still be on-trend, Mintel reported. In fact, the firm noted 23% of skin care users have added a step to their skin care routine in 2020. “Traditional products, such as moisturizer, lip balm and facial cleanser continue to dominate consumer usage, and are considered essentials by roughly half of consumers. However, young adults, Asian and Hispanic consumers demonstrate elevated interest in specialty products. Interest in alternative product formats among key demographics could take share from traditional product staples.”

Women aged 18-34 are heavily invested in skin care routines and are the most likely to use a wide range of products, especially alternatives to traditional formats, per Minel. “To achieve their skincare goals, women are more willing than men to take steps to change their routine and improve their skin, such as trying a new brand or adding a new step, reflecting their overall engagement in this space.”

The COVID Effect

With people working remotely during the pandemic, many have been less focused on appearances, Molyneaux suggested. “Due to stay-at-home jobs, more women are foregoing wearing makeup these days. However, skin care has remained just as important as it was prior to the pandemic and maybe more so as the condition of your skin is more visible.”

Additionally, consumer focus has shifted somewhat due to COVID-19, as people consider the shelf-life/stability of packaged goods, including beauty and personal care products, according to Mintel.

“The anxiety and uncertainty caused by this pandemic leads to a greater need for reliable and safe beauty and personal care products,” said Hennigan. “Products that mitigate risks of contamination by utilizing touchless formats and offer extended shelf life to consumers rationing supplies and/or unable to obtain alternatives will stand out as being safe and dependable. Brands that demonstrate their dependability, transparency and willingness to take action to ensure product safety will be rewarded by consumers.”

Nourishing skin, hair and nails is even more important when consumers can’t get an appointment at a salon, said Michini. “People who are living without such conveniences are still keeping healthy via supplementation, and this includes skin, hair and nails.”

Despite a decrease in overall consumer spending, online purchases are up, Bornet noted. “Social distancing and measures for consumers to stay home have prompted higher demand for easily accessible, science-backed skin care products and ingredients, as access to self-care services like facials are limited, or in some regions unavailable completely.”

In addition, the pandemic has raised awareness about the importance of a healthy lifestyle, and wellness more broadly. Skin is the human body’s largest organ, and consumers understand that beautiful skin is, above all, healthy skin. Based on a more holistic approach to health, they seek natural solutions which provide multi-tasking benefits, including for skin and beauty.

Initially consumers slowed purchases of beauty products during the pandemic, said Ferren, however, “as we are getting back to a ‘new normal,’ our customers that use our ingredients for beauty from within formulas are seeing strong sales again.”

References: https://www.nutraceuticalsworld.com/issues/2020-Beauty-IO/view_features/new-beauty-market-disruption-but-not-interruption/